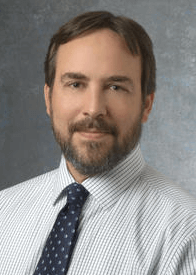

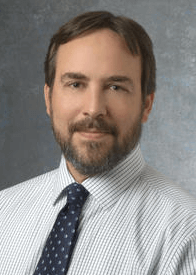

Professor Wyatt Newman – Electrical Engineering Consultant

Goldowsky hires Prof. Wyatt Newman, someone he had worked with at Phillips Laboratories, promises to pay him in a mix of cash and stock in Gold Medical Technologies and then, after years of work, he not only doesn’t pay him the cash, but to avoid paying a $55,595.00 judgment he lost against Newman, who sued Gold Medical in 2004, Goldowsky deliberately bankrupts Gold Medical Technologies, in an attempt to make Prof. Newman’s stock worthless and the judgment he had been awarded, unenforceable.

Goldowsky hires Prof. Wyatt Newman, someone he had worked with at Phillips Laboratories, promises to pay him in a mix of cash and stock in Gold Medical Technologies and then, after years of work, he not only doesn’t pay him the cash, but to avoid paying a $55,595.00 judgment he lost against Newman, who sued Gold Medical in 2004, Goldowsky deliberately bankrupts Gold Medical Technologies, in an attempt to make Prof. Newman’s stock worthless and the judgment he had been awarded, unenforceable.

In a newsletter mailed to all the shareholders, dated July 27, 2005, Goldowsky announced that the suit with Prof. Newman was now over, and that it had been settled substantially on Gold Medical’s terms. He thanked Mr. Jonathan Kagan, a key investor, for his financial assistance to bring this to a conclusion, but he never told the shareholders that thanks to his unethical and immoral conduct, he actually lost the case and cost Gold Medical Technologies a judgment of $55,595.00.

According to Prof. Newman, Goldowsky told him that even though he had won the judgment against Gold Medical, he would see to it that he would never collect, and that he would file for bankruptcy.

As indicated by Prof. Newman’s testimonial below, when Goldowsky created the new company, he arbitrarily decided who was going to receive replacement stock in the new company and who would be left out. According to amendment #4 of the shareholders agreement dated January 24, 2002, this option exercised by Goldowsky is not stated, in fact quite the contrary is clearly noted.

CLICK HERE to see Shareholders Agreement – Amendment 4

CLICK HERE to view judgment document

Here is Prof. Newman’s testimonial:

Aldo,

This message is in follow-up to our phone conversation of today. As we discussed, my experience with Michael Goldowsky sounds similar to your own. I had previously worked with Mike at Philips Laboratories.Years later (approximately 2003) I was contacted by Mike to provide technical assistance with his heart-pump design. For approximately 2 years, I worked for Mike developing rotor-drive and active magnetic suspension characterization and control (both code and electronics). Our arrangement was that I would be paid in a mix of cash and stock in Gold Medical Technologies, Inc.

I received stock from Mike, but the cash payments were chronically late. It eventually became clear that he did not intend to pay me. I subsequently sued him, and won a judgement against Gold Medical Technologies, Inc. However, I was unable to collect on the judgement. Goldowsky claimed that Gold Medical Technologies had been dissolved, and he created a new company to which he transferred his patent licenses. In a newsletter announcing his new company, he described how some Gold Medical Technologies stockholders would be given stock in his new company. I was not one of those to receive such stock.

It is my understanding from our conversation of today that Gold Medical Technologies, Inc was never formally dissolved. Presumably, then, Gold Medical Technologies still has the IP patent rights–and thus such rights might be illegally claimed to be owned by multiple companies. I also learned from you that a condition of stock ownership in Gold Medical Technologies should have qualified me for corresponding ownership in Mike’s subsequent company(ies), and this was not extended to me (which also sounds illegal).

I agree with you that Mike is not a suitable CEO for advancing the heart-pump technology that has been developed to date with investor funds. He has a history of using bankruptcies (improperly executed, it appears) to avoid paying obligations and to cheat investors. I am aware that he has a history of making enemies, including getting fired from Philips Laboratories over his personality issues. These are not characteristics that will lead to successful commercialization of the developed technology.

If the heart-pump technology can realize success by removing Goldowsky as CEO, I believe this would be a positive action for the benefit of stockholders.

Sincerely,

Wyatt Newman

Goldowsky hires Prof. Wyatt Newman, someone he had worked with at Phillips Laboratories, promises to pay him in a mix of cash and stock in Gold Medical Technologies and then, after years of work, he not only doesn’t pay him the cash, but to avoid paying a $55,595.00 judgment he lost against Newman, who sued Gold Medical in 2004, Goldowsky deliberately bankrupts Gold Medical Technologies, in an attempt to make Prof. Newman’s stock worthless and the judgment he had been awarded, unenforceable.

Goldowsky hires Prof. Wyatt Newman, someone he had worked with at Phillips Laboratories, promises to pay him in a mix of cash and stock in Gold Medical Technologies and then, after years of work, he not only doesn’t pay him the cash, but to avoid paying a $55,595.00 judgment he lost against Newman, who sued Gold Medical in 2004, Goldowsky deliberately bankrupts Gold Medical Technologies, in an attempt to make Prof. Newman’s stock worthless and the judgment he had been awarded, unenforceable.